Revolut has undoubtedly revolutionised the fintech industry. More than nine million users have already been infected by a London based company.

In this article, based on our existing knowledge and experience, we decipher the Growth Hacking strategy and tactics behind Revolut’s expansion using publicly available data to show the relationship between features and growth strategy.

Revolut

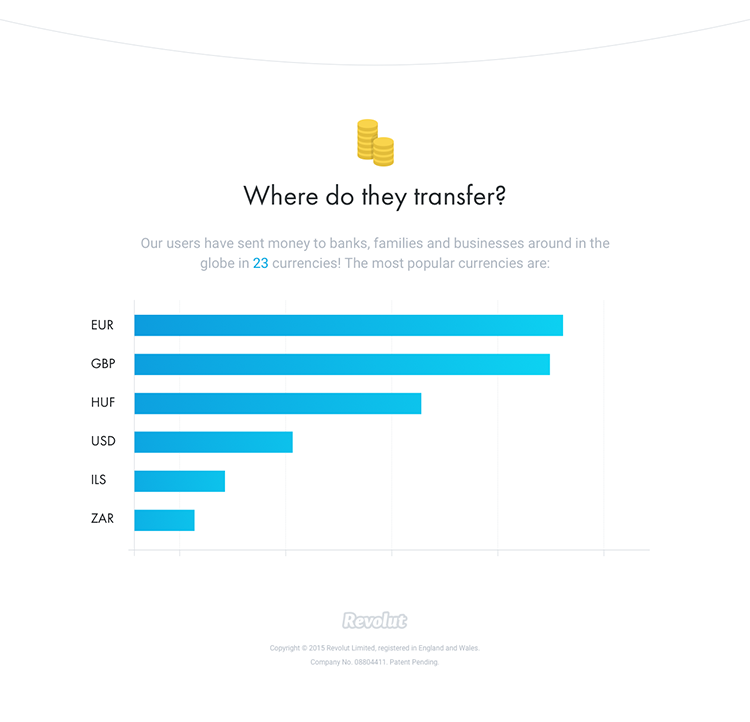

Revolut promises users a brand new way of managing money, even on the brand level. A fintech startup company that issues pre-paid cards: these cards allow you to switch between currencies at an interbank rate, which is especially useful for those who travel or shop online a lot. The latter is supported by their numerous services: virtual disposable cards, free microtransactions, IBAN number, free transfer, etc. Of course, both Android and iOS run the company’s application.

You can top up your account free of charge, so you can change currencies slightly above the interbank rate, giving you an advantage after each conversion. Furthermore, with the Revolut card, you can withdraw cash in up to 29 supported currencies, even overseas (however, ATM companies must pay fees).

Of course, as a Fintech company, Revolut offers numerous additional services: you can buy insurance, buy cryptocurrency, or even donate. It is also very useful for everyday credit card payments in any country, since money transfer to our bank is considered a purchase and therefore is free. Revolut is available free of charge with a small shipping cost, but if you request via a friend’s invitation, you will not have to pay this amount.

However, under the hood, there are extreme growth and real challenges. With such a public interest, providing the service is a horridly difficult task, with 10-16 working hours per day and continuous specialist recruitment, almost unsustainable KPIs and regular firefighting. Not exactly a relaxed state, but the visions are quite ambitious.

.

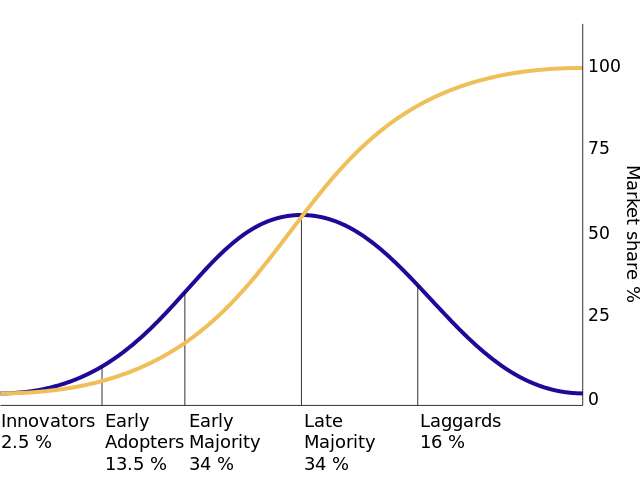

The business model of the Revolut product can also be deduced from purely public data, which we will break down into different phases of innovation.

Diffusion of innovations is a theory that seeks to explain how, why, and at what rate new ideas and technology spread. Everett Rogers, a professor of communication studies, popularized the theory in his book Diffusion of Innovations; the book was first published in 1962, and is now in its fifth edition (2003).[1] Rogers argues that diffusion is the process by which an innovation is communicated over time among the participants in a social system. The origins of the diffusion of innovations theory are varied and span multiple disciplines.

source: wikipedia

The rise of the NEO BANKING

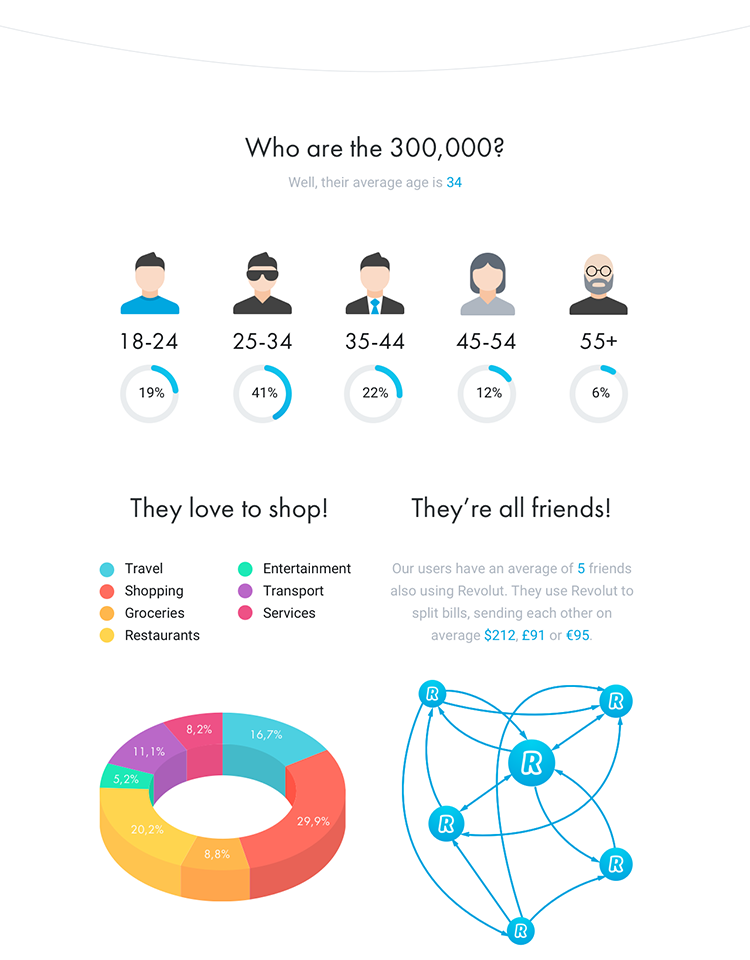

Propagation speed is (ha ez már letelt, akkor was) very strong even during the product validation phase. 300,000 users activated the account in a year, which clearly means the product is marketable. This outcome was achieved by targeting a group of potential small and medium-sized businesses to identify the real pain points.

What kind of pain could you resolve with Revolut?

Pain: Hidden Costs

Pain reliever: Free and instant money sending and receiving within the system

–

Pain: Too high and unnecessary expenses, extra transaction costs, unfavourable exchange rates.

Pain reliever: Favourable exchange rate conversion

–

Pain:Maintaining costly foreign currency accounts, applying for separate credit cards, exchange rate conversions, etc.

Pain reliever: Instant foreign currency account

–

Pain: Long and complicated account opening, requires personal presence.

Pain reliever: Immediate registration

–

Pain: Applying for a credit card is expensive, unsafe, blocking it is complicated and it costs extra to switch back

Pain reliever: Free credit card* – instant card lock and easy to use.

–

Pain: Banking surfaces are obsolete in UX, and are slow to use

Pain reliever: Easy to use, Fluid UI, High User Experience

–

Keywords: SEND, SPEND, SAVE

In a December 2018 post, Revolut added 7,000 users a day. Currently, it has exceeded its 9 million user base in December 2019, and between August and November 2019 the spread rate is 22,000 new users per day.

According to an interview with Val Sholz’s, former VP of Growth, he said with their three million user base they were at 2% *. Which means, projected to the table above, they have an estimated total market of 150 million users.

The Unicorn in the Early Adoption Stage is expected to keep this rate up to 24 million users, but communication is continuously changing, as usual.

The First Users

Innovators

The Innovators category will always be the first user base of the startup product. They are the ones who leap into novelty, keep an eye on trends, look for fresh and modern tools, new approaches, and are willing to take risks when trying a new thing. They are tolerant of mistakes and bugs. Not necessarily developers, tech users need to be considered, these kind of habits could come from any industries.

The communication strategy of the Revolut team focuses on hubs and distributors who are very likely to positively value immediacy. Typically stockbrokers, startuppers, geeks can spread it. However, in order to convince this category, they need to build their personas and customise the app for their needs in the early phase. This means that they do not develop extra unnecessary functions, but those that can serve this category to the maximum. There is a strong emphasis on UX, instant money transfer, and currency conversion, as the peculiarities of Personas are that they are travelling around the world. For them, the exchange rate fluctuation and the extra costs involved can be identified as a pain point.

On average they have a turnover of 95 Euros

Early marketing communication

- Send money with free

- Cut your hidden banking costs to zero. Sign up to find out how.

- Simply Revolutionary

- The new way to instantly send and spend money

globally with zero fees.

source: web.archive.org

Churn – First losing point

One of the earliest drop-off points is the barrier to creating an account, so opening a bank account needs to be fully digitalised. The registration should be the same or less difficult than signing up to any social platform. Word-of-mouth is strong as a marketing channel, which requires a high NUX, which is very important in Growth Hacking.

The New User Experience (NUX), refers to the first impression and the extent of the experience of new users

If the experience of the new users is disappointing, they feel misaligned or lost, then they will definitely not recommend the product. And the recommendation is the primary factor for developing a viral loop.

Funnel flipping tactics:

Funnel flipping is the tactical approach of building a sales funnel upside down. In other words, the goal is not to acquire, but to maximise retention and recommendation. The recommendation is a much stronger external motivator than any advertisement.

Let me show the questions in a flipped order

- As a user, Why am I going to recommend this product?

- As a user, Why am I willing to spend money?

- As a user, Why am I going to use the product regularly?

- As a visitor, why will I decide to sign up and try the app?

- What motivators will make me download the app and check out the page?

- What service related problems do I have that a product can resolve? What are the keywords I notice?

Funnel flipping is always useful if you want to build a sales strategy from a different perspective; also, it sets our attitude and approach in a way that growth will be incorporated into the DNA of our product.

The first 300,000 users typically had 5 contacts in the system and had an average age of 34 years. On average they have a turnover of 95 Euros.

The Persona map defined at an early stage undergoes changes during different stages of growth. There is definitely a change in interests and attitudes towards risk, so communication must be transformed as well.

If a growing startup does not change its website or main message, it will stagnate after a while as the target market moves away from it.

Their targeted communication is based on correlations, such as openness to technical innovations like the Apple Watch, or access to the airport lounge, as 16% of the targeted audience are regular travelers. The lounge, for example can be found in the app, but also the Millennial category is targeted, for whom a game represents extra value during the onboarding process.

The onboarding jargon was first used in 1970 to train employees in the workplace. In the SaaS industry, onboarding enables the user to learn about the features of a product and how to use them.

Early Adopters

Usually early adopters are users who need a so-called forerunner who has already experienced the strengths and weaknesses of the system. Their motivation also focuses on new things but typically requires at least one credible information. Be it a friend or even an acquaintance of a friend (This will later on serve as the fundament of Social Proof, which stands for the principle of trust based on the community). Early in the adopter phase, they rely heavily on product influencers, or the users from the previous stage called innovators.

The value proposition (the value that a product can provide to the user) does not necessarily change radically, and communication has a shift in emphasis from novelty and upscale to benefit. Personas are no longer necessarily those looking for novelty and „coolness”, but a category that can make their lives a little easier with the product. Revolut also has a prominent role in the UI experience (UX), which also reduces time and unnecessary mental strain.

BAD UX:

If you are filling in a form and you have to scroll up to the top just to submit it, you have to look for the submit button, which is an unnecessary mental task for the brain to solve this micro-problem.

Good UX:

If you go to an ATM to withdraw cash, you only receive the amount after you take back your credit card. If we receive the amount sooner, we are much more likely to leave our credit card in the ATM. So UX has secretly saved us from unnecessary mental strain and annoyance.

—

The Early adopter persona is typically an international traveler with a vibrant personality having multiple currencies in their pocket. The benefits for them are the instant money transfer, currency exchange, exchange rate management, quick account opening, free transactions, and cross-border payment options.

Early adopters are also willing to risk.

If the company is able to meet the needs of the various phases and respond quickly and efficiently enough, it is expected to reach 80-100 million users in the next 4 years. The cornerstone of keeping up with the trend is that they continue to respond effectively to account blockings and other distrust factors, as proven by the existence of a negative KPI strategy.

Eliminate negative reputation

The Company applies internal KPIs to almost every process, from the appearance of positive PR articles through the introduction of a new feature to the conquest of a new market. These are called “Business Goal KPIs”

It uses negative KPIs, however, to hold the importance of eliminating bad judgment at an organizational level, which is called the „Business Debt KPI„. This includes, for example, the ratio of one-star rated services or cases where customers have been deceived for some reason.

Negative KPIs also fall into the category of “Business Risk KPIs”, which have a direct negative impact on customers, owners or investors. For example, if a transaction ends up in the wrong account.

Revolut: North Star Metric

The North Star Metric (NSM) is no more than a quantifiable way to value a product. And the North star is the goal the organization has set for itself: Revolutionising Money Management.

In the case of a Revolut, the potential North Star Metric is decrypted from communication. This requires a little deeper knowledge of value creation and the point at which the user realises that the product is actually making their life easier. This point is called the „AHA” moment. The AHA moment, of course, appears in Revolut’s behavior and development.

Revolut’s earliest AHA moment:

– when a user realises how easy it is to convert their money to currency under very good conditions

and

– when the user realises that he can transfer money to a friend faster than he could reach into his pocket and physically give it to them. Plus he can do it anywhere in the world, anytime, for free.

Although, the app does much more than these two features. Since from insurance, through the management of cryptocurrencies, it is experimenting with countless features – and in many cases the AHA moment requires completely different communication and measurement points – you need to provide a very simple and quick experience during the acquisition and activation phase. Essentially, a product is also a marketing channel.

Because a transaction between friends happen more frequently than a currency exchange, onboarding and the viral loop are also focused on this. Thus, the AHA moment will be observed at the earliest in case of instant transactions, ie, when transferring money to another Revolut user free of charge.

Disabling credit cards, notifying you of deductions, or incoming transfers are some of the extra features we are either currently paying for or that are inconvenient to us. So from a user point of view, it is definitely a painful point.

However, one of the best ways to maximise user engagement is to create a connection between offline and online, that is, digital systems and physically tangible devices, which in this case is the Revolut card. Therefore, the costs of manufacturing and shipping, which are otherwise well paid by traditional banks, are funded by Revolut from the marketing budget. Because the card should be treated as a marketing tool, it gives you a way, like Apple products, to go far beyond a plastic card in a simple envelope.

One key indicator of Revolut is the number of early adopters who have five friends and who have made a financial transaction of at least 5 Euros because they understand why the service is so good for them.

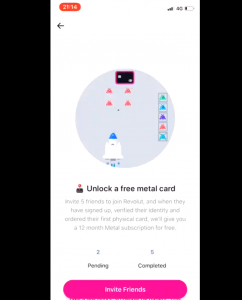

„Invite 5 friends and get a reward” – Using a viral loop, an invite is rewarded, like Dropbox example

So the Growth strategy for REVOLUT is to bring in as many users as possible to make a transaction of at least five Euros. If the AHA moment is met, users are significantly more likely to return. They try out additional features like currency purchase and eventually redeem the card. Unfortunately, it is not possible to decipher the average balance of users who typically redeem the card, but it is advisable not to compare it to the amount but to the chronological distance from the First TouchPoint.

Because the strategy is provided, they are constantly promoting the activity that is in focus, both in communication and within the app.

So to reach the first level, ie acquisition, viral propagation loops are used, the reason for which is now understood. A referral from a friend can build much more trust than thirty ads.

What’s more, the AHA moment is fulfilled if you not only have the App, but also someone you can interact with. For Facebook, for example, determining the number of connections in the early stages of a growth strategy was the primary metric. Once a user had at least 7 friends, he understood what the social network was all about and had a significantly lower dropout rate. Of course, this had to happen within a certain amount of time (7 days).

The interaction in case of Revolut is the movement of money. Recharging works just like paying by credit card in the web store. There will be an immediate transfer to our account and no transfer charges. That is, if you loose the credit card issued by your bank, you can deposit and pay with your Revolut account at the touch of a button. You can solve this at a cashier. Let’s face it, it’s a very „Fancy” thing (Immediacy).

Revolut North Start Metrics for Early Adopter Stage:

The real north star metric is financial transactions, e.g. saving money, spending money, sending money, investing money, etc.

User needs to be acquired through at least two AHA moments:

- Send and receive money

- Multiple currency account management for one card

MOA = Monthly active users. Typically the number of monthly active users is one of the primary KPIs,

Anyone in this world has to pay money at some point, whether this is for rent, groceries or travel.

In some cases uses tend to be using Revolut more frequently (e.g. if you pay your groceries with your Revolut card), in other cases less frequently (whenever I travel abroad).

The ultimate goal is to get people to use Revolut on a daily basis, however, this might take years to shift people’s behaviour from a travel card that is used once a year (or a few times a year) to an everyday card.

The future of Revolut

The growth of Revolut is extraordinary and although we can call it unicorn with a calm heart, it is not profitable yet. There are many challenges the fintech startup needs to face, but it will definitely make a big difference in money management. Let’s see some directions from the previous signs.

The financial revolution is reaching the business world and this is no longer a prediction, as Revolut Business is available, which has provided a perfect foundation for targeting personal users. It is true that creating Business Accounts is not a new thing, as it offers features for business use since 2017, and social communication is highly targeted to end users.

After all, anyone who has been using it for some time and is satisfied with the service will eventually be forced to open up, especially if you are in a B2C business. Thanks to this, they can provide end-users with easy payment options that banks have been trying to catch up to for years, but have been missing to do so (eg: Payment links, instant transfers).

Revolut’s speed of development is outstanding, making it impossible for a financial organization to compete with.

Focus on the end user

Money manager applications are very popular nowadays, but the main issue is data collection. Once the data is available, transactions are categorised by the systems so that refueling or grocery costs can be displayed in nice graphs. The functionality can be perfectly tested and polished in the end user group, and, provided that it has sufficient data available, it will be smarter than we can imagine. Processing transaction data and obtaining business-valuable information is a service in demand, as virtually every small business creates its own CashFlow table. The same applies to households, where missing data is an obstacle to financial awareness.

The organisation’s goal is to execute as many transactions as possible through Revolut, so categorising transactions clearly reinforces retention.

To increase daily card usage, it is advisable to focus on Revolut’s savings, which is still an end-user function. Because they collect the sum of the roundings of each transaction separately, the customer increases their savings with each purchase.

The next level could be when the app does not only stores your money but you can also invest. In currency, securities, etc.

Multiple accounts

The recent update made it possible to manage multiple accounts with a single login. This feature significantly expands the boundaries of the personal finance app to the family cashier, as if other members of the family are considered new users (ez nem kerek nekem, magyarul sem).

With the spirit of the revolution in mind, the next big step in the family may be to target young people under 18. While there are many objections, looking at the age group called Alpha, which many call digital natives, it will be a perfectly legitimate step forward that pocket money will not come in physical form but as a „notification”. The company made several references of creating a cashless society.

The above statement sounds steep to many, but if any startup can do it, it’s Revolut.

Conclusion

For growth, the user categories targeted at different phases are of importance, as they will be an indicator of the next and larger user categories. The presence of Harvard students, who were considered „innovators”, had a very strong impact on the initial spread of Facebook, which itself created a sense of exclusivity.

Revolut reaches business users by circling them with personal profiles. So when business accounts start joining, they are not treated as a risk, but as an opportunity to join a new ecosystem. The model is not new. In parallel, the TikTok fever runs in front of us, where there is hardly any business opportunity to analyze, advertise.

Just like into the app, the growth is also coded into the organisation, which we call the Growth Mindset. Investor pressure is enormous, and achievable goals are ambitious enough to encourage the company to look in one direction only: upwards (forward inkább?).

Revolut, therefore, promises a revolution and is no less than the goal of becoming the Amazon of finance.

If you Like it, you share it

https://www.linkedin.com/in/andras-sarkozi